- English

- Español

- Português

- русский

- Français

- 日本語

- Deutsch

- tiếng Việt

- Italiano

- Nederlands

- ภาษาไทย

- Polski

- 한국어

- Svenska

- magyar

- Malay

- বাংলা ভাষার

- Dansk

- Suomi

- हिन्दी

- Pilipino

- Türkçe

- Gaeilge

- العربية

- Indonesia

- Norsk

- تمل

- český

- ελληνικά

- український

- Javanese

- فارسی

- தமிழ்

- తెలుగు

- नेपाली

- Burmese

- български

- ລາວ

- Latine

- Қазақша

- Euskal

- Azərbaycan

- Slovenský jazyk

- Македонски

- Lietuvos

- Eesti Keel

- Română

- Slovenski

- मराठी

- Srpski језик

Is there only a ternary battery between the Ningde era and the peak of Waterma and the imminent bankruptcy?

2022-11-08

Life is always like this, bumpy, ups and downs, so is the development of the industry. Looking back on 2018, in the power battery industry, what events made you sigh?

They say that life is like a box of chocolates. You never know what you're going to get. This sentence is most suitable for the Ningde era and Watma.

It was only seven years old. On June 11, 2018, Ningde Times landed in the A-share market, and its valuation once reached 130 billion yuan, standing at the top of the industry. According to the data from the Research Department of Power Battery Application Branch of China Chemical and Physical Power Supply Industry Association, from January to November 2018, the total installed capacity of the top ten enterprises in the power battery industry was about 43.5 GWh, and Ningde Times ranked first with about 17.9 GWh of power battery installed capacity, accounting for 41.03%.

In 2017, Watma, which has been established for 16 years, ranked third in domestic power battery shipments and fourth in global power battery shipments. However, in 2018, its parent company, Jianrui Voneng, had a debt crisis, with the overall debt of 22.138 billion yuan and overdue debt of 1.998 billion yuan; Also in June 2018, Waterma sent a six-month holiday notice to all employees due to insufficient orders and financial difficulties; Recently, it has been beset with lawsuits. For various reasons, Waterma is on the verge of bankruptcy.

In 2018, one company reached the top and took the lead; A family was on the verge of bankruptcy and was caught in a dilemma. The reason can be seen in this way.

Different technical route decisions

Ningde Times and Watma started out as lithium iron phosphate batteries at first, and caught up with the policy support. The two battery leading enterprises, together with BYD and others, entered the "white list" of the first batch of power batteries of the Ministry of Industry and Information Technology. The orders were received easily, and the installed capacity of Watma once ranked first in the field of new energy logistics vehicles in China.

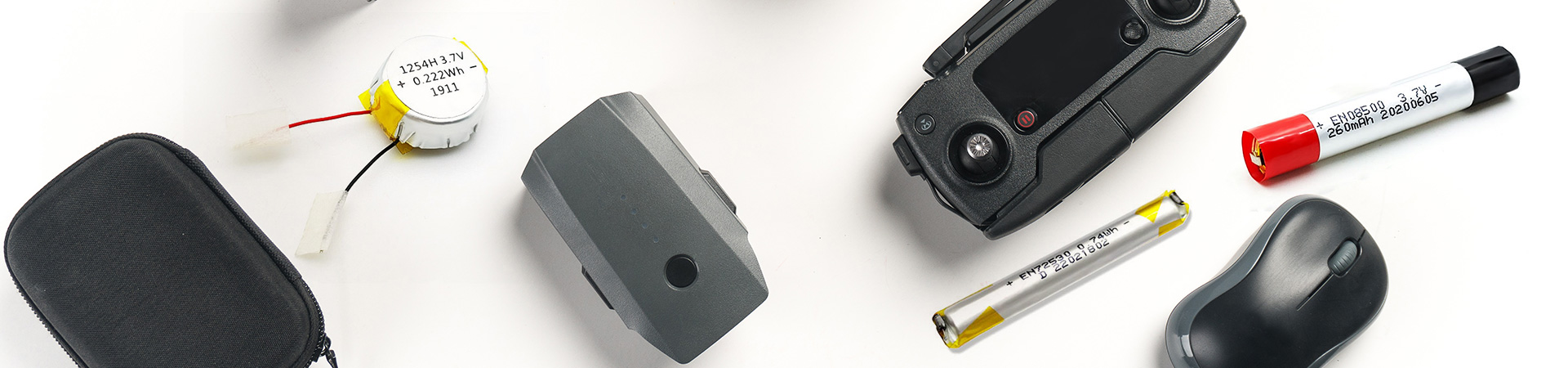

However, as the regulatory authorities began to tilt towards the high energy density of power batteries in terms of subsidies for new energy vehicles, ternary batteries, known for their high energy density and long endurance mileage, quickly swept the market and won favor, while lithium iron phosphate batteries with relatively low energy density began to shrink in the market share of passenger cars and logistics vehicles.

Ningde Times quickly understood the policy direction and adjusted the technical route in time. In addition to developing the existing lithium iron phosphate battery, it also took the R&D and production of ternary battery as an important business. According to the public information, 5% of the total annual sales of Ningde Times is used for science and technology research and development. At the same time, Ningde Research and Development Center has been set up to introduce equipment with huge investment in order to conduct comprehensive analysis and testing of the battery system.

However, Watma seems to be possessed by the devil and insists on taking the route of lithium iron phosphate. The management, including Li Yao, the chairman of the board of directors, agreed that technology and the market are not the same thing. The power battery is a complex that integrates safety, life, energy density and cost. It is not allowed to blindly and independently evaluate a certain performance without leaving the comprehensive performance of the system.

This understanding of the senior management of Watma was "sound" in itself, but at that time, the battery enterprises relied too much on the subsidies received by the car enterprises, and it was somewhat "boring and pedantic" to just emphasize comprehensiveness. This understanding also directly led to the slowdown in the development of ternary batteries by Watma, which delayed the production of ternary batteries. The product's oneness has increased its risk, which makes it unable to cope with changes in the industry in the later period.

In addition, according to the new subsidy standard for new energy vehicles in June 2018, the minimum requirements for the energy density of the power battery system of pure electric trucks or special vehicles, and non fast charging buses are raised to 115Wh/kg.

It is understood that among the power batteries sold by Waterma in 2017, only 14.3% of lithium iron phosphate batteries had a system energy density of 115Wh/kg, and quite a few batteries did not meet the new policy subsidy standards. This means that most of Watma's products cannot be subsidized.

Without subsidies, there is no market, and Waterma gradually loses customers.

They say that life is like a box of chocolates. You never know what you're going to get. This sentence is most suitable for the Ningde era and Watma.

It was only seven years old. On June 11, 2018, Ningde Times landed in the A-share market, and its valuation once reached 130 billion yuan, standing at the top of the industry. According to the data from the Research Department of Power Battery Application Branch of China Chemical and Physical Power Supply Industry Association, from January to November 2018, the total installed capacity of the top ten enterprises in the power battery industry was about 43.5 GWh, and Ningde Times ranked first with about 17.9 GWh of power battery installed capacity, accounting for 41.03%.

In 2017, Watma, which has been established for 16 years, ranked third in domestic power battery shipments and fourth in global power battery shipments. However, in 2018, its parent company, Jianrui Voneng, had a debt crisis, with the overall debt of 22.138 billion yuan and overdue debt of 1.998 billion yuan; Also in June 2018, Waterma sent a six-month holiday notice to all employees due to insufficient orders and financial difficulties; Recently, it has been beset with lawsuits. For various reasons, Waterma is on the verge of bankruptcy.

In 2018, one company reached the top and took the lead; A family was on the verge of bankruptcy and was caught in a dilemma. The reason can be seen in this way.

Different technical route decisions

Ningde Times and Watma started out as lithium iron phosphate batteries at first, and caught up with the policy support. The two battery leading enterprises, together with BYD and others, entered the "white list" of the first batch of power batteries of the Ministry of Industry and Information Technology. The orders were received easily, and the installed capacity of Watma once ranked first in the field of new energy logistics vehicles in China.

However, as the regulatory authorities began to tilt towards the high energy density of power batteries in terms of subsidies for new energy vehicles, ternary batteries, known for their high energy density and long endurance mileage, quickly swept the market and won favor, while lithium iron phosphate batteries with relatively low energy density began to shrink in the market share of passenger cars and logistics vehicles.

Ningde Times quickly understood the policy direction and adjusted the technical route in time. In addition to developing the existing lithium iron phosphate battery, it also took the R&D and production of ternary battery as an important business. According to the public information, 5% of the total annual sales of Ningde Times is used for science and technology research and development. At the same time, Ningde Research and Development Center has been set up to introduce equipment with huge investment in order to conduct comprehensive analysis and testing of the battery system.

However, Watma seems to be possessed by the devil and insists on taking the route of lithium iron phosphate. The management, including Li Yao, the chairman of the board of directors, agreed that technology and the market are not the same thing. The power battery is a complex that integrates safety, life, energy density and cost. It is not allowed to blindly and independently evaluate a certain performance without leaving the comprehensive performance of the system.

This understanding of the senior management of Watma was "sound" in itself, but at that time, the battery enterprises relied too much on the subsidies received by the car enterprises, and it was somewhat "boring and pedantic" to just emphasize comprehensiveness. This understanding also directly led to the slowdown in the development of ternary batteries by Watma, which delayed the production of ternary batteries. The product's oneness has increased its risk, which makes it unable to cope with changes in the industry in the later period.

In addition, according to the new subsidy standard for new energy vehicles in June 2018, the minimum requirements for the energy density of the power battery system of pure electric trucks or special vehicles, and non fast charging buses are raised to 115Wh/kg.

It is understood that among the power batteries sold by Waterma in 2017, only 14.3% of lithium iron phosphate batteries had a system energy density of 115Wh/kg, and quite a few batteries did not meet the new policy subsidy standards. This means that most of Watma's products cannot be subsidized.

Without subsidies, there is no market, and Waterma gradually loses customers.